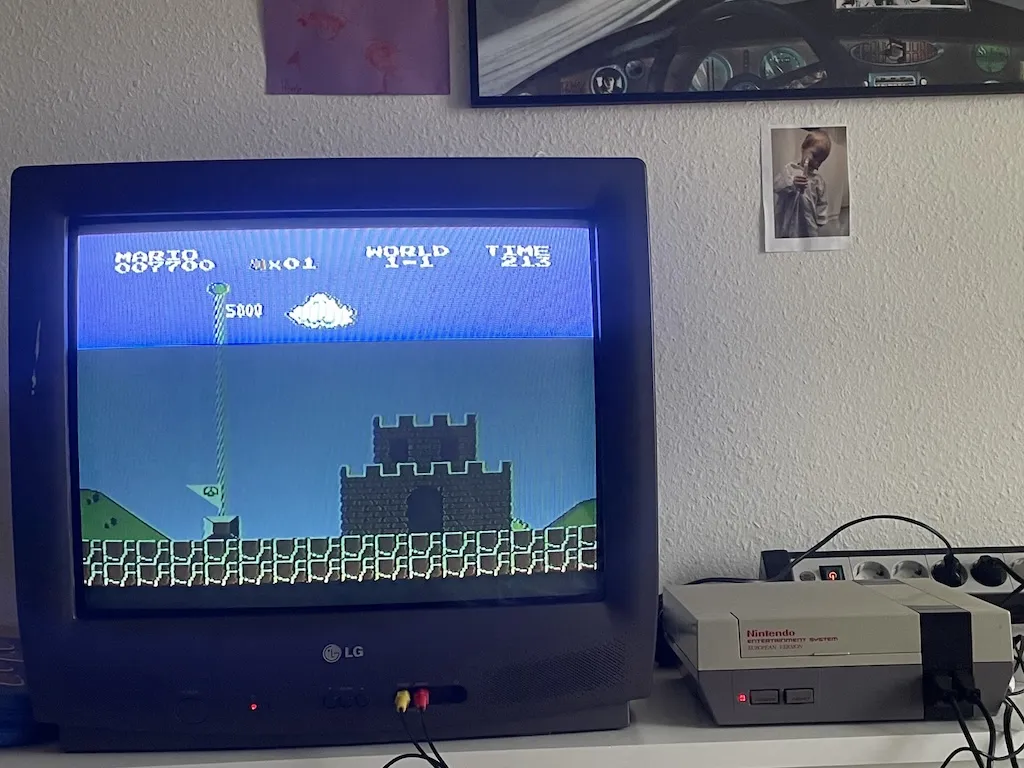

Spotting a dirt cheap CRT television in a second hand shop in Trelleborg last weekend set in motion a chain of events that led to a Nintendo and a copy of Super Mario Bros arriving in the mail. Only thing is, none of it bloody worked. I got the old flashing red light when turning it on, and once blowing in the cartridge didn't sort it I was out of ideas. Fortunately I found a very helpful YouTube video that walked me through fixing it.

Opening the thing up required a philips screwdriver. The were four screws to remove and then I was in.

The goal of the disassembly is to remove the 72 pin connector for inspection and cleaning. To get to it, I had to remove another bunch of philips screws. It was handy to have a magnetic mat to keep them organised on for this part.

Once I had the 72 pin connector out, I cleaned it really thoroughly with some isopropyl alcohol. The connectors on the cartridge also got a thorough clean.

After that came the reassembly, which went fine. It's a bit of a leap of faith at that point as you don't know if you've resolved the issue yet.

Fuck knows what the next step would have been if this hadn't sorted it. Buying a new 72 pin connector maybe? Thing is with buying the console and the cartridge at the same time, you can't be sure which one the problem's coming from. In that sense I was lucky this worked.

Very fun to work with my hands and repair something. Excited to have an old school Nintendo now as well. Definitely think it's going to help the kids have a healthier relationship to their screen time compared to the addictiveness of the endless choice of the dozens of games installed on the Switch as well.